Donate

The Gentry Foundation for Autism is an IRS Section 501(c)(3) non-profit organization, and is a qualifying charitable organization registered with the Arizona Department of Revenue.

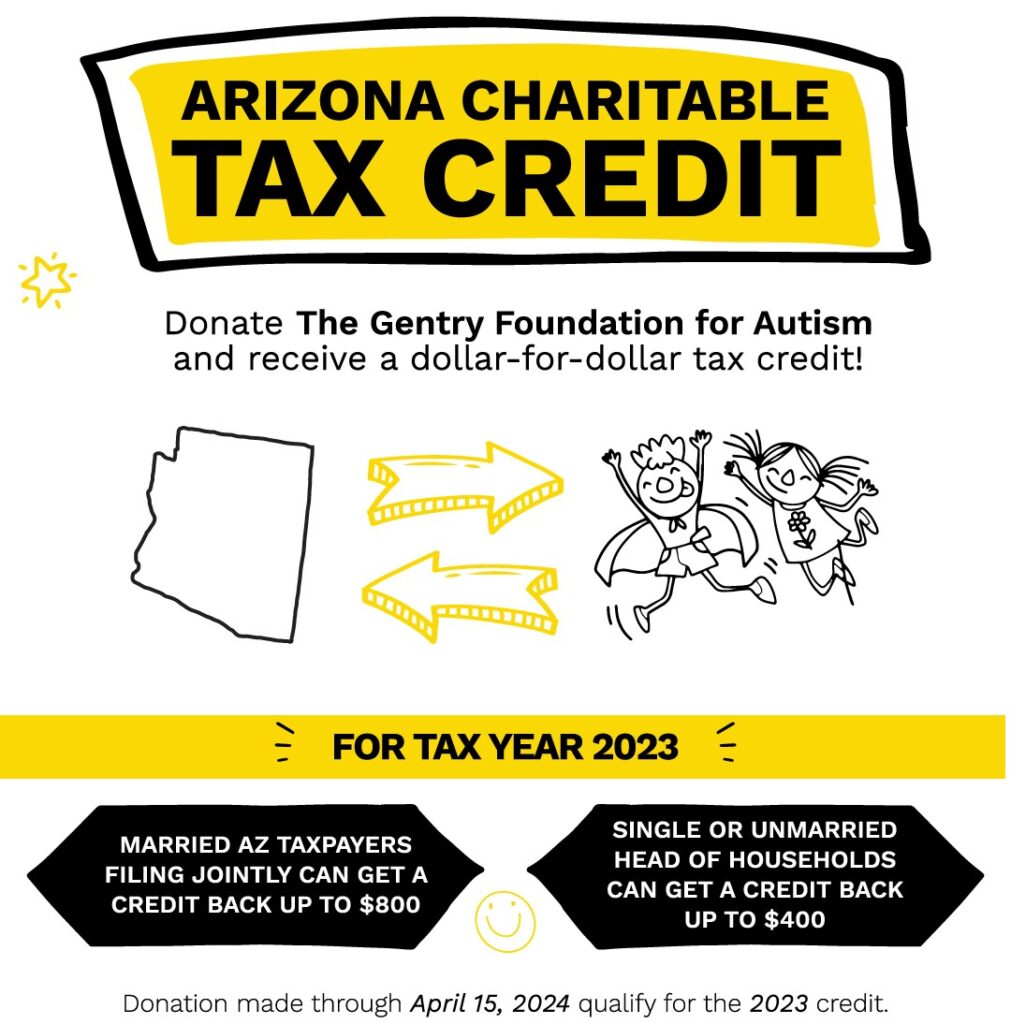

Thanks to the Arizona Charitable Organization Tax Credit Law, A.R.S. § 43-1088, you are able to designate a donation to The Gentry Foundation for Autism and receive a tax credit. For tax year 2023, contributions up to $800 earns dollar-for-dollar tax credit on your Arizona Income Tax return. Arizona taxpayers filing as single or unmarried head of household have a maximum credit amount of $400; married Arizona taxpayers filing joint have an $800 maximum credit. Donations made through April 17, 2023 qualify for the 2022 credit.

Scroll to the link at the bottom of this page to learn about donating from a DAF.